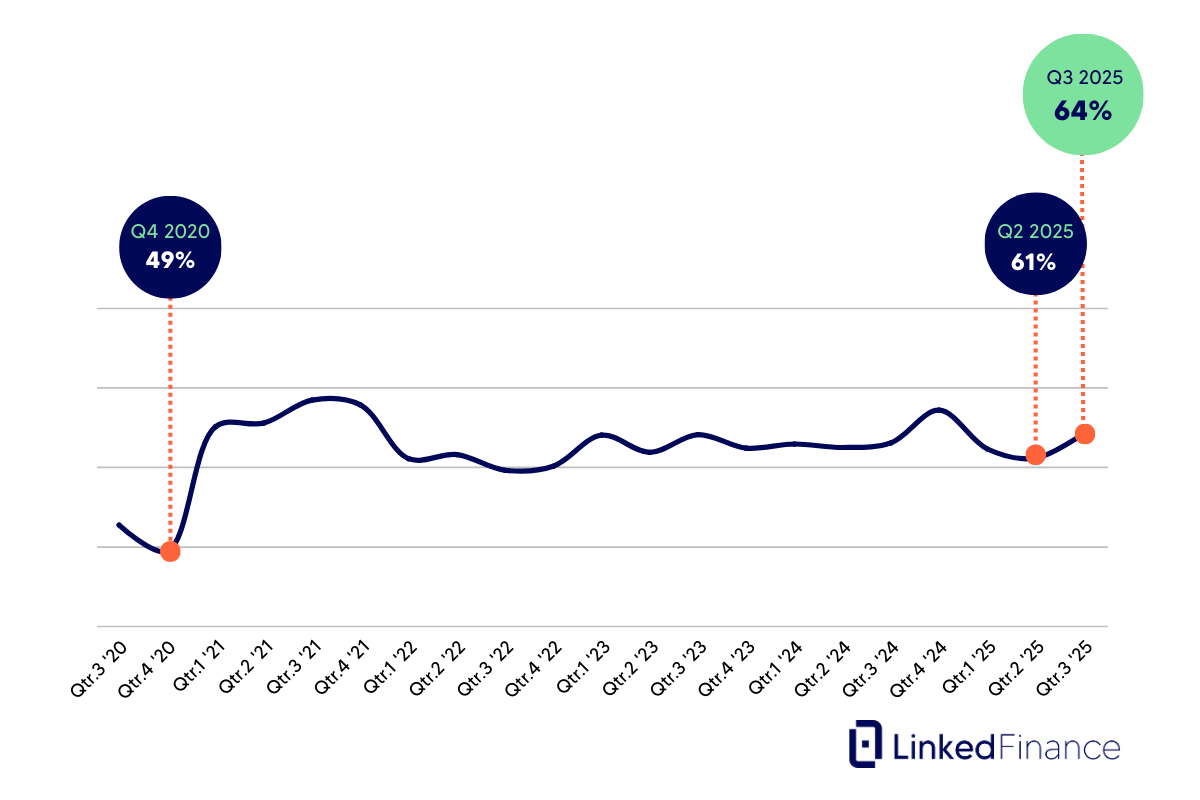

Irish SMEs are entering the final stages of 2025 with renewed confidence, according to the latest Linked Finance SME Confidence Index. After a challenging period earlier in the year, sentiment is now moving firmly in the right direction, signalling stability and cautious optimism across the SME landscape.

Confidence Rebounds After Early-Year Dip

The confidence index rose from 61% in Q2 to 64% in Q3, putting it close to the peak of 67% recorded at the end of 2024. Mid-sized and larger firms remain the most upbeat, while micro-businesses continue to show more caution. Services businesses report the strongest sentiment, with Dublin-based SMEs slightly more positive than those elsewhere.

Trading Conditions Gradually Improving

The balance of trading performance continues to normalise.

- 28% reported higher turnover than in Q3 2024.

- 31% reported lower turnover.

- The rest saw little change.

This marks a clear improvement from last year, when declines were more widespread. Profitability shows a similar trend, with most firms reporting steady or improving margins.

A Cautious View of Q4 2025

Expectations for the final quarter are more reserved.

- 30% expect higher turnover.

- 34% expect a decline.

- 36% expect broadly similar trading to last year.

This is the first time since 2023 that more SMEs expect a dip rather than a lift in the coming quarter, though two-thirds still expect conditions to be stable or better.

Employment Holds Steady

The jobs market has settled, with 79% of SMEs reporting no change in headcount. Job reductions are concentrated in consumer-facing sectors, while most recruitment is being driven by mid-sized and larger firms.

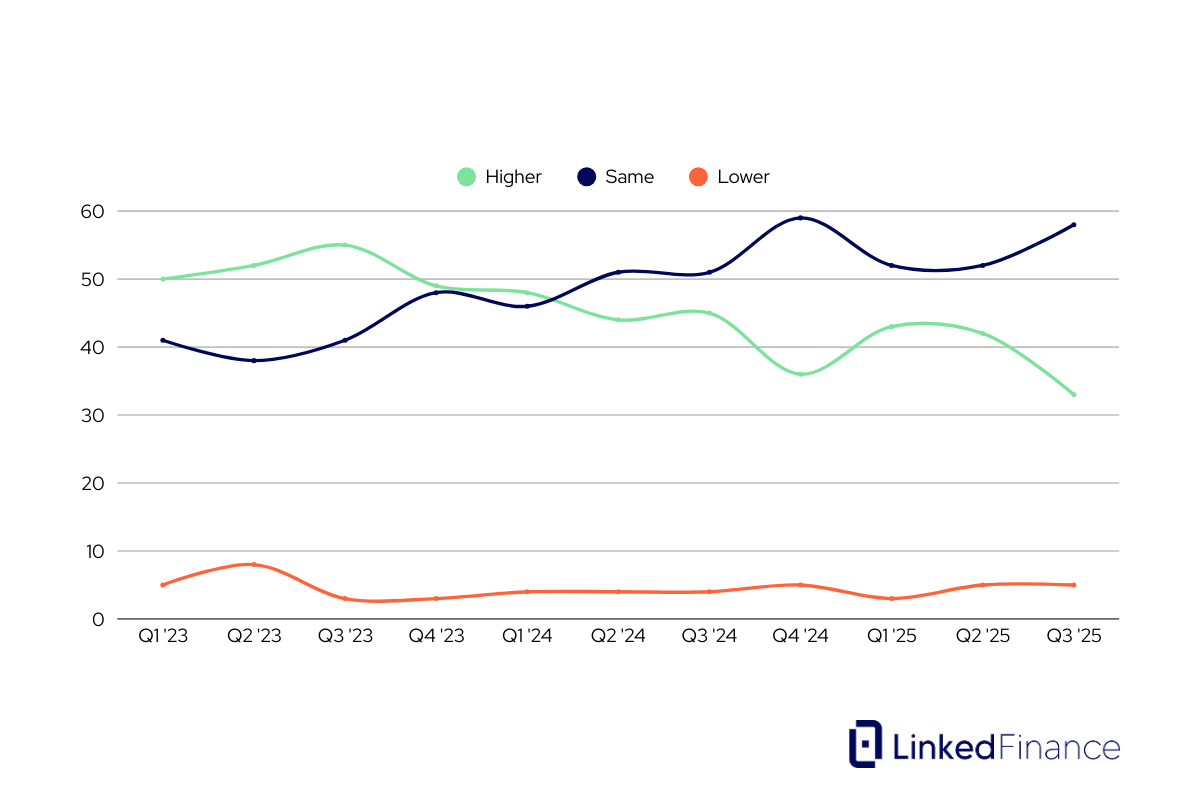

Price Pressures Easing

Price-setting behaviour has moved towards more typical patterns.

- Only 33% raised prices this year (down from 45% in 2024 and 55% in 2023).

- 58% kept prices stable.

- 5% reduced prices.

For customers, this means a calmer pricing environment; for businesses, it means tighter margins.

A Wide-Ranging Risk Landscape

Inflation remains the dominant concern, cited by 67% of SMEs. Other prominent risks include:

- Technology & cyber threats (41%).

- Macroeconomic uncertainty (36%).

- Skills shortages (36%).

- Trade issues & tariffs (30%).

- AI impacts (30%).

- Climate change (17%).

CEO Perspective: A Sector Rebuilding Strength

Linked Finance CEO Niall O’Grady notes:

“Many businesses are telling us that 2025 has turned out better than they feared in the spring, and we are seeing that reflected in the improvement in sentiment and trading indicators compared with this time last year.

The direction of travel is clearly positive, with confidence now close to the highs we saw at the end of 2024. While expectations for the final quarter remain naturally cautious, the majority of firms anticipate stable or stronger trading than in 2024, which gives us real grounds for optimism as we look towards 2026.”

Conclusion

The Q3 2025 Index paints a picture of an SME sector regaining stability, adapting to challenges and preparing cautiously for the critical year-end period. With sentiment rising and trading conditions improving, many businesses are well-positioned to move forward, provided they have the right financial support at the right moment.

To learn how Linked Finance can help your business take its next step, speak to a lending specialist today.

The quarterly Linked Finance SME Confidence Index survey is conducted by Ipsos B&A via telephone and online amongst a sample of 359 Business owners/Managers countrywide. These were weighted in line with the total size profile of all businesses. The sample is quota-controlled in terms of region and size of operation (employee numbers). Fieldwork conducted 8th – 27th October ’25.