Ukraine Credit Guarantee Scheme

Business term loans for Irish SMEs who have been impacted by economic challenges associated with the Russian invasion of Ukraine.

Ukraine Credit Guarantee Scheme

Business term loans for Irish SMEs who have been impacted by economic challenges associated with the Russian invasion of Ukraine.

From rising energy and raw material costs to supply chain disruptions, many Irish businesses have been impacted by the ongoing conflict in Ukraine.

To further support Irish businesses, we have partnered with the Strategic Banking Corporation of Ireland (SBCI) to offer you a loan under the Ukraine Credit Guarantee Scheme.

From rising energy and raw material costs to supply chain disruptions, many Irish businesses have been impacted by the ongoing conflict in Ukraine.

To further support Irish businesses, we have partnered with the Strategic Banking Corporation of Ireland (SBCI) to offer you a loan under the Ukraine Credit Guarantee Scheme.

Loan Features:

Loan Features:

- Loans from €10,000 to €250,000.

- Repayment terms from 1-5 years.

- Unsecured business loans for:

– Working Capital.

– Investment. - For businesses that have experienced an increase in costs of at least 10% on their 2020 cost figures due to the Russian invasion of Ukraine.

- Loans from €10,000 to €250,000.

- Repayment terms from 1-5 years.

- Unsecured business loans for:

– Working Capital.

– Investment. - For businesses that have experienced an increase in costs of at least 10% on their 2020 cost figures due to the Russian invasion of Ukraine.

The Ukraine Credit Guarantee Scheme (UCGS) is offered by the Department of Enterprise, Trade and Employment (DETE) to provide viable SMEs and Small Mid-Caps, including primary producers, impacted by economic challenges arising from the conflict in Ukraine. Visit the SBCI for further details, here.

The Ukraine Credit Guarantee Scheme (UCGS) is offered by the Department of Enterprise, Trade and Employment (DETE) to provide viable SMEs and Small Mid-Caps, including primary producers, impacted by economic challenges arising from the conflict in Ukraine. Visit the SBCI for further details, here.

UCGS Overview

UCGS Overview

Loans from €10,000 to a maximum of €250,000 per borrower. Repayment terms from 1-5 years.

Loans from €10,000 to a maximum of €250,000 per borrower. Repayment terms from 1-5 years.

The eligible financial product is term loan facilities with loan amounts up to €250,000. Term loans will be unsecured.

The eligible financial product is term loan facilities with loan amounts up to €250,000. Term loans will be unsecured.

Amounts greater than €250,000 may be secured; however, a personal guarantee may only be sought in circumstances where it is required to capture supporting security, or where it is an uncollateralised personal guarantee and is limited to a maximum of 20% of the initial finance agreement amount.

Amounts greater than €250,000 may be secured; however, a personal guarantee may only be sought in circumstances where it is required to capture supporting security, or where it is an uncollateralised personal guarantee and is limited to a maximum of 20% of the initial finance agreement amount.

Up to 90 days interest and/or capital moratoria are possible under the scheme. These remain at the discretion of the participating on-lender. Loans will be available up to 31 December 2024 or until the scheme has been fully subscribed.

Up to 90 days interest and/or capital moratoria are possible under the scheme. These remain at the discretion of the participating on-lender. Loans will be available up to 31 December 2024 or until the scheme has been fully subscribed.

Interest rates and premiums

Interest rates and premiums

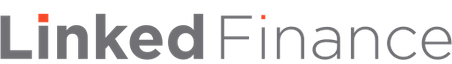

The interest rate applicable to the loan will be determined by Linked Finance.

The interest rate applicable to the loan will be determined by Linked Finance.

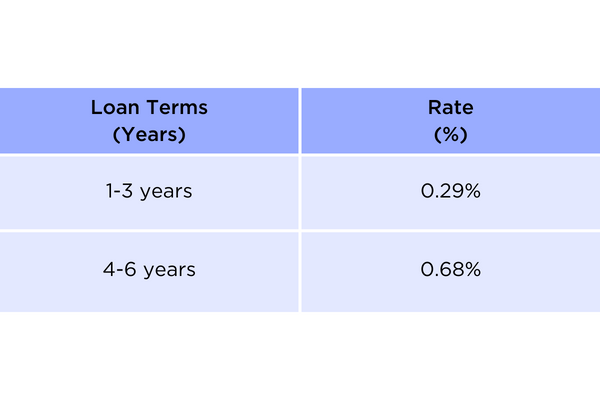

In addition, Linked Finance will collect a premium which is payable to the Government of Ireland. The risk premium rate that will apply will depend on the size of the business and the length of time for which the credit is being advanced, as per the tables below:

In addition, Linked Finance will collect a premium which is payable to the Government of Ireland. The risk premium rate that will apply will depend on the size of the business and the length of time for which the credit is being advanced, as per the tables below:

Ukraine Guarantee Scheme FAQ

Ukraine Guarantee Scheme FAQ

There is a two-step process to apply for a loan under the Ukraine Credit Guarantee Scheme:

Step 1: First register for an SBCI eligibility code through the SBCI Hub, here.

Step 2: Once you get the SBCI eligibility code, fill out our SBCI Lending Scheme Enquiry Form.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme range from €10,000 to €250,000.

The SBCI eligibility code is valid for six months from the date of issue, but it is always subject to the scheme remaining open and having funding available.

The SBCI eligibility code you get for your first loan can only be used once. For second and subsequent loans you must complete a new eligibility application form and get a new SBCI eligibility code.

Once you have drawn down a loan, the declarations provided within the eligibility application form will need to be updated for the second and subsequent loans. The second eligibility code can be used multiple times, provided that you don’t exceed the maximum loan amount available under the Scheme and the eligibility code hasn’t expired.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme can be for terms of up to five years in duration (provided that the terms of any loan require it to be repaid in full by no later than 31 December 2030).

Under the Ukraine Credit Guarantee Scheme loans can only be used for working capital and/or investment purposes.

No. The Ukraine Credit Guarantee Scheme does not allow for the refinancing of existing loans/debt products.

No. The Ukraine Credit Guarantee Scheme does not allow for the purchase of Agri Land.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme will be determined by Linked Finance’s internal credit process.

Loans under the Ukraine Credit Guarantee Scheme provided by Linked Finance up to €250,000 will be made on an unsecured basis.

If the loans are with two different on-lenders, they will both be on an unsecured basis up to €250,000.

The risk premium rate that will apply will depend on the size of the business and the length of time for which the credit is being advanced, as per below:

- 1-3 year term: 0.29%

- 4-6 year term: 0.68%

This risk premium represents the cost to the Government in providing the 80% guarantee scheme to the participating on-lenders.

Approval depends on the loan amount involved and if Linked Finance has all the information needed to process an application.

Yes. You can get more than one loan, provided that the total of those loans does not exceed the maximum loan amount available to you under the Scheme.

You may apply for multiple loans under the Ukraine Credit Guarantee Scheme provided that the cumulative loan amount does not exceed the lesser of a) and b), where a) is €1 million and b) is the amount equal to the loan amount thresholds set out on the SBCI Hub in respect of limits provided under State Aid Regulation, such amount itself being the greater of:

i) 15% of the borrower’s average total annual turnover over the last three closed accounting periods;

ii) 50% of the borrower’s energy costs over the 12 months preceding the month when the aid application is submitted.

Loans will be available up to 31 December 2024, or until the scheme has been fully subscribed.

The Ukraine Credit Guarantee Scheme operated under the EU “Temporary Crisis Framework” (TCF) for State aid measures to support the economy following the outbreak of the conflict in Ukraine up until 31st December 2023.

From the 1st January 2024 the Ukraine Credit Guarantee Scheme will operate under:

- General De Minimis Aid Regulation.

- Agriculture De Minimis Aid Regulation.

- Fisheries De Minimis Aid Regulation.

Where you have received State aid, you will have received a letter from the State body that provided it. Examples of State aid granting bodies include Enterprise Ireland, Bord Bia or the Local Enterprise Office.

NACE stands for the “Statistical Classification of Economic Activities in the European Community”. It is the standard system used in the European Union for classifying business activity. NACE codes are divided into sectors such as retail, manufacturing, services etc.

The list of NACE Codes eligible for the Ukraine Credit Guarantee Scheme is available on the

SBCI website.

It means that the applicant operates their business and has a registered business address in Ireland.

A primary producer is a person engaged in the production, rearing or growing of primary products including harvesting, milking and farmed animal production. It also includes fishing and the harvesting of wild products.

Approval of a loan under the scheme is subject to the Linked Finance credit policy. The maximum loan amount may not be appropriate in every case. If you are not satisfied with the reason given, you can undergo the Linked Finance appeal process.

There is a two-step process to apply for a loan under the Ukraine Credit Guarantee Scheme:

Step 1: First register for an SBCI eligibility code through the SBCI Hub, here.

Step 2: Once you get the SBCI eligibility code, fill out our SBCI Lending Scheme Enquiry Form.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme range from €10,000 to €250,000.

The SBCI eligibility code is valid for six months from the date of issue, but it is always subject to the scheme remaining open and having funding available.

The SBCI eligibility code you get for your first loan can only be used once. For second and subsequent loans you must complete a new eligibility application form and get a new SBCI eligibility code.

Once you have drawn down a loan, the declarations provided within the eligibility application form will need to be updated for the second and subsequent loans. The second eligibility code can be used multiple times, provided that you don’t exceed the maximum loan amount available under the Scheme and the eligibility code hasn’t expired.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme can be for terms of up to five years in duration (provided that the terms of any loan require it to be repaid in full by no later than 31 December 2030).

Under the Ukraine Credit Guarantee Scheme loans can only be used for working capital and/or investment purposes.

No. The Ukraine Credit Guarantee Scheme does not allow for the refinancing of existing loans/debt products.

No. The Ukraine Credit Guarantee Scheme does not allow for the purchase of Agri Land.

Loans provided by Linked Finance under the Ukraine Credit Guarantee Scheme will be determined by Linked Finance’s internal credit process.

Loans under the Ukraine Credit Guarantee Scheme provided by Linked Finance up to €250,000 will be made on an unsecured basis.

If the loans are with two different on-lenders, they will both be on an unsecured basis up to €250,000.

The risk premium rate that will apply will depend on the size of the business and the length of time for which the credit is being advanced, as per below:

- 1-3 year term: 0.29%

- 4-6 year term: 0.68%

This risk premium represents the cost to the Government in providing the 80% guarantee scheme to the participating on-lenders.

Approval depends on the loan amount involved and if Linked Finance has all the information needed to process an application.

Yes. You can get more than one loan, provided that the total of those loans does not exceed the maximum loan amount available to you under the Scheme.

You may apply for multiple loans under the Ukraine Credit Guarantee Scheme provided that the cumulative loan amount does not exceed the lesser of a) and b), where a) is €1 million and b) is the amount equal to the loan amount thresholds set out on the SBCI Hub in respect of limits provided under State Aid Regulation, such amount itself being the greater of:

i) 15% of the borrower’s average total annual turnover over the last three closed accounting periods;

ii) 50% of the borrower’s energy costs over the 12 months preceding the month when the aid application is submitted.

Loans will be available up to 31 December 2024, or until the scheme has been fully subscribed.

The Ukraine Credit Guarantee Scheme operated under the EU “Temporary Crisis Framework” (TCF) for State aid measures to support the economy following the outbreak of the conflict in Ukraine up until 31st December 2023.

From the 1st January 2024, the Ukraine Credit Guarantee Scheme will operate under:

- General De Minimis Aid Regulation.

- Agriculture De Minimis Aid Regulation.

- Fisheries De Minimis Aid Regulation.

Where you have received State aid, you will have received a letter from the State body that provided it. Examples of State aid granting bodies include Enterprise Ireland, Bord Bia or the Local Enterprise Office.

NACE stands for the “Statistical Classification of Economic Activities in the European Community”. It is the standard system used in the European Union for classifying business activity. NACE codes are divided into sectors such as retail, manufacturing, services etc.

The list of NACE Codes eligible for the Ukraine Credit Guarantee Scheme is available on the

SBCI website.

It means that the applicant operates their business and has a registered business address in Ireland.

A primary producer is a person engaged in the production, rearing or growing of primary products including harvesting, milking and farmed animal production. It also includes fishing and the harvesting of wild products.

Approval of a loan under the scheme is subject to the Linked Finance credit policy. The maximum loan amount may not be appropriate in every case. If you are not satisfied with the reason given, you can undergo the Linked Finance appeal process.