Business optimism rises for Irish SMEs for the first time in 12 months

Index Snapshot:

- First significant rise in confidence for Irish SMEs in over 12 months.

- Business Optimism Index increases to 64.

- 27% of business owners reported business activity growth.

- 50% of businesses reported charging higher prices for their products.

The economy continues to show signs of recovery as optimism amongst businesses in Ireland’s SME sector increased in the first quarter of 2023. According to the latest Linked Finance SME Confidence Index, based on research conducted by Behaviours & Attitudes, business optimism was at 64 in Q1 2023 (scored out of 100), up from a level of 60.2 in Q4 2022.

In the face of growing economic pressures and the cost of raw materials, this is a significantly positive move in the right direction for business owners and investors.

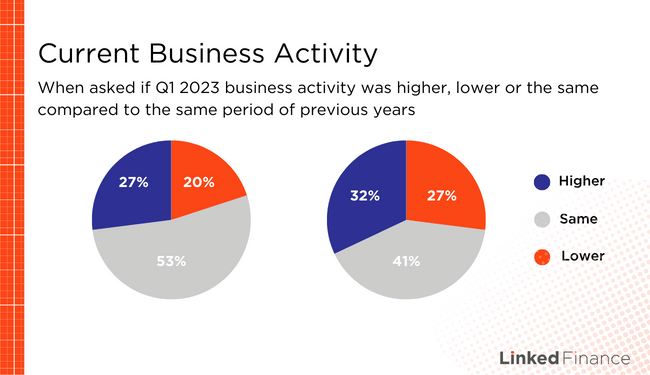

Current business activity has largely remained steady since the same period last year. 53% of surveyed businesses stated that business activity had remained the same in Q1 2023 in comparison to Q1 2022.

A further 27% reported an increase in business activity since the same period last year.

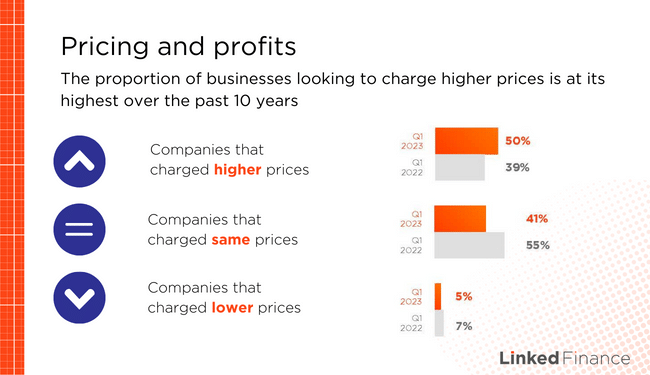

However, consumers may have experienced less positivity during this period. 50% of businesses reported charging higher prices for their products, as opposed to 39% reporting the same in Q1 2022.

The proportion of businesses looking to charge higher prices is at its highest level over the past 10 years as business owners grapple with wider economic issues.

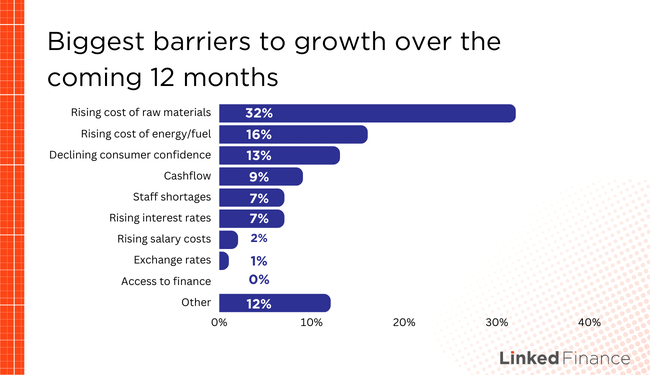

These economic issues are wide-ranging. The rising cost of raw materials (32%) and the rising cost of energy and fuel (16%) were reported as being the biggest barriers to growth over the coming 12 months.

Linked Finance is witnessing this resurgence first-hand with more than €31.7 million in loans issued in the first half of 2023, which is almost 90% more than the €16.8 million in loans issued during the same period in 2022.

On the back of this, Linked Finance is expecting 2023 to be its busiest year yet, forecasting the deployment of €65 million in loans, representing an average growth of 50% in each of the last three years.

This positive trend not only benefits businesses but also creates opportunities for investors on the platform to capitalize on these market opportunities and maximize their returns.

To learn more about Linked Finance financing options click here or call 01 906 0300.

This research was conducted by Behaviours & Attitudes and reflects business performance in Quarter 1 2023 and projections for Quarter 2 2023. Fieldwork was conducted between April 18th – May 5th 2023.