The latest Linked Finance SME Confidence Index highlights the difficulty for Irish SMEs in accessing credit as the traditional banking sector shrinks.

The Q4 2021 Linked Finance SME Confidence Index was released in February 2022.

Behaviours & Attitudes surveyed 354 SME business owners/Chief Executives across multiple sectors and counties to get their views on recent business results, projected employment levels, profit margins and expectations for the forthcoming year.

Key findings

Difficult in accessing credit

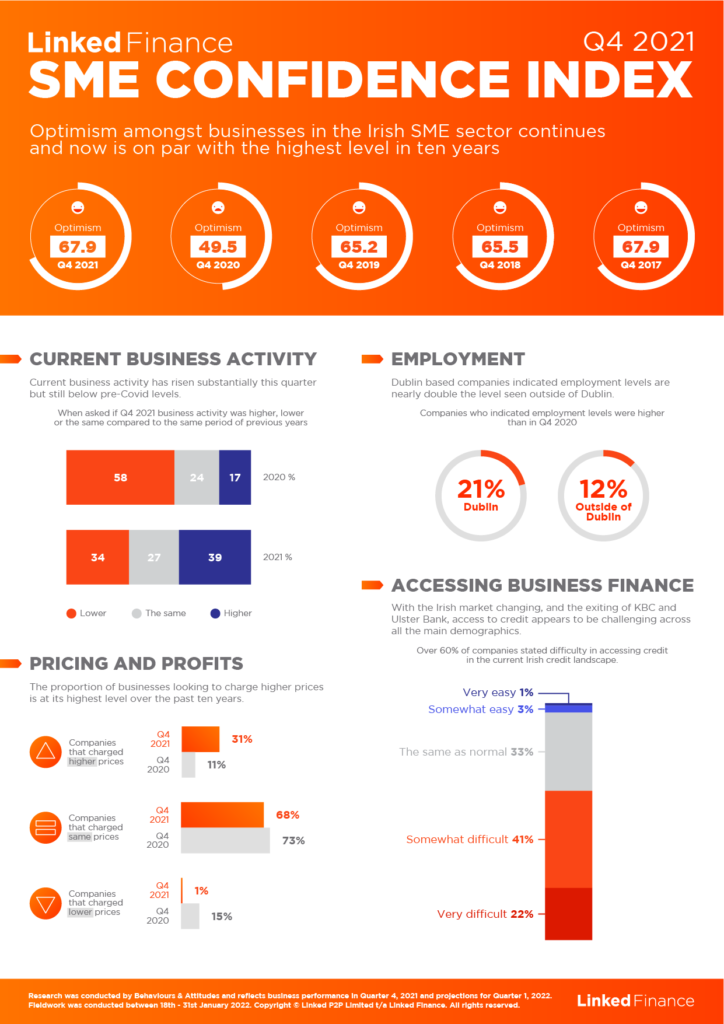

According to the latest figures from the latest quarterly Linked Finance SME Confidence Index, almost two-thirds (63%) of Irish SMEs are finding it difficult to access credit, creating a barrier to economic recovery.

Even with increased support for Irish SME businesses throughout the pandemic via payment breaks and loan forbearance Irish SMEs still face difficulties in gaining access to fast and flexible working capital. SMEs were asked in light of the planned exits of Ulster Bank and KBC from the Irish market how easy or difficult did they expect it to be to borrow money in 2022: 22% of respondents said ‘very difficult’ and 41% ‘somewhat difficult’.

SME confidence

Despite concerns about the availability of credit, the latest Index showed Business Optimism at a level of 67.9 (out of 100), up from 49.5 a year ago, and close to the all-time high it reached of 69.1 in Q3 2018. The business outlook for SMEs is also good with 48% of companies expecting business next quarter will be higher (33% the same, 19% lower).

Given the data was largely gathered prior to the Government’s further easing of restrictions on 21st January, a further improvement in sentiment is expected next quarter. SMEs have continued to adjust and adapt to the shocks felt throughout the pandemic, and as the economy reopened 39% of SMEs were already reporting higher business activity in Q4 2021, compared to 17% in the final quarter of 2020.

Price inflation

Price inflation remains a thorn in the side of the economic recovery. The Index found that the proportion of businesses looking to charge higher prices is at its highest level in ten years, with 31% of companies charging higher prices in Q4 2021. The findings are consistent with the most recent CSO consumer price index for December which showed an annual inflation rate of 5.5%, a 20-year high.

“Access to credit is the lifeblood of any fast-growing SME and the latest Index findings indicate that many businesses are facing challenges borrowing money. That’s come as the traditional banking sector is shrinking with the planned departure of Ulster Bank and KBC from the market. Our aim at Linked Finance is to break down barriers to growth by offering easy to access financing options with fast credit decisions and fast drawdowns.

We welcome the greater recognition from Government that there now is of the important role of alternative lenders, who help to maintain competition in the SME lending market. The CBI’s recent announcement of plans to introduce a regulatory framework for peer-to-peer lending is positive as it will provide long overdue reassurance for lenders and borrowers.

The broader economic picture shown by the Index is positive, with business optimism returning to pre-pandemic levels and companies looking to hire new staff. The biggest red flag is around inflation pressure and the growing number of companies that are increasing prices and thereby contributing to the inflation rate being at its highest level in 20 years. SMEs facing higher costs understandably need to increase prices, but we must be careful to avoid a sustained upward price spiral.”

Niall O’Grady, CEO, Linked Finance

Research was conducted by Behaviours & Attitudes and reflects business performance in Quarter 4, 2021 and projections for Quarter 1, 2022. Fieldwork was conducted between 18th – 31st January 2022.