Open banking was introduced as part of the EU regulation, Payment Services Directive 2, but what does it mean for Irish SMEs applying for finance?

What is open banking?

As part of the EU regulation, Payment Services Directive 2 (PSD2), open banking was introduced in an effort to increase competition and choice for businesses, as well as consumers. As part of the regulation, customers can opt to share their transactional data with third parties, like Linked Finance.

What does it mean for my business?

Gone are the days where banks and financial institutions have control over your information and financial data. Thanks to open banking, that control sits with you.

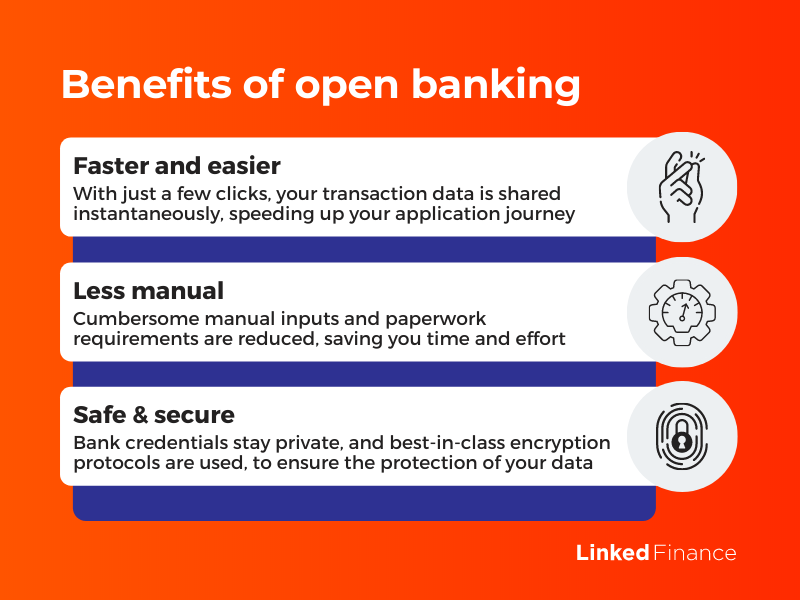

Open banking allows you to share your business bank account information and transaction data with third parties such as Linked Finance. The hassle of locating, downloading and uploading bank statements as part of our loan application process is a thing of the past. With just a few clicks, you can now share your transactional data to support your application. You are always in control of what transactional data you choose to share with data shared safely and securely.

What are the benefits of linking my business bank account with my Linked Finance application?

How does open banking work with my loan application?

Open banking is embedded into the Linked Finance application process to make it straightforward and hassle-free. Once logged into your Linked Finance account, follow the step-by-step instructions on the screen to be directed to your bank’s online banking system (your login credentials remain private at all times and never shared with Linked Finance.) Your bank will ask you to verify that it is you (usually through a notification to your mobile phone) and confirm that you are happy to give Linked Finance access to your data to assist your funding application.