The latest Linked Finance SME Confidence Index includes a focus on sustainability and the Climate Action Plan.

The Q3 2021 Linked Finance SME Confidence Index was released in November 2021.

Behaviours & Attitudes surveyed 357 SME business owners/Chief Executives across multiple sectors and counties to get their views on recent business results, projected employment levels, profit margins and expectations for the forthcoming year.

Included in the quarterly interview of SMEs were the Climate Action Plan and sustainable business models. As the world looked to COP26 in October this year, Linked Finance was keen to get feedback from Irish SMEs on what it meant for their businesses.

Overall, there were positive indicators from the Index. The optimism score amongst Irish SMEs was 68.5 (up from 52.8 in Q3 2020), close to the all-time high of 69.1 in Q3 2018. Employment trends were also positive, with expectations of hiring staff at their highest level since 2014.

As optimism and the job growth rate increase, so does inflationary pressures. Pressures were particularly notable in larger SMEs (10+ employees), where 41% charged higher prices. 30% of companies are charging higher prices in Q3, compared to the previous year. This figure is more than three times the level of companies hiking prices a year ago and at a record level in a data series going back to 2011. Whilst SMEs face challenges from rising input costs, an inflationary spiral could damage competitiveness and the emerging economic recovery post lockdown.

SME Confidence Index key takeaways

- The confidence level is at 68.5 in Q3 2021, up from 52.8 a year ago

- 30% of Irish SMEs charging higher prices in Q3 than a year ago

- Employment expectations are at a seven-year high, but the challenge now is labour shortages

Sustainability findings

- Two in five businesses are concerned with the challenge represented by the Climate Action Plan

- Concern around the Climate Bill peaks amongst exporters

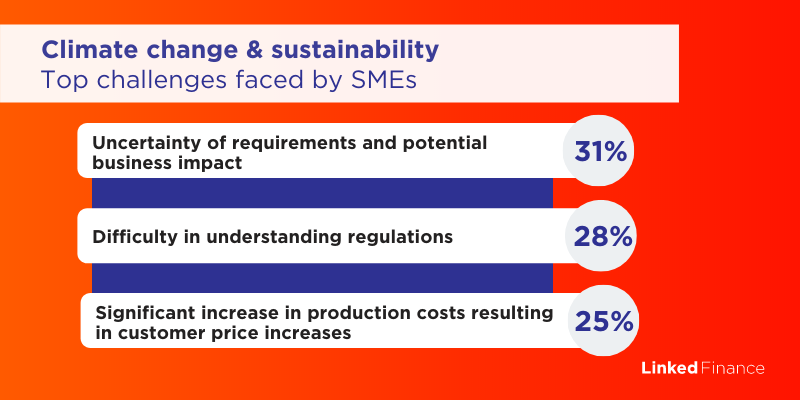

- The main challenges SMEs face in shifting to a more sustainable business model include

- Uncertainty of requirements and potential business impact

- Difficulty in understanding regulations

- Significant increase in production costs resulting in customer price increases

“This quarter’s index shows that economic trends for the SME sector are positive, with strong current trading sentiment and future expectations improving. The biggest cause for concern is the accelerating pace of inflation, which is shown both in our survey and the CSO data.

We all know that the threat of climate change is real, but when it comes to adapting your business to new regulations it’s not straightforward. SMEs clearly need help and practical guidance as to how they can make their contribution to the new targets the Government has put in place. We must be mindful that there will likely be a cost burden for businesses in reducing their carbon footprint.”

Niall O’Grady, CEO, Linked Finance

Research was conducted by Behaviours & Attitudes and reflects business performance in Quarter 3, 2021 and projections for Quarter 4, 2021. Fieldwork was conducted between 12th – 18th October 2021.