Optimism amongst Irish SMEs makes a strong recovery

The inaugural Linked Finance SME Confidence Index launched in September 2021.

The quarterly report aims to provide a barometer of sentiment in the Irish SME sector. Accounting for 1M+ jobs, the SME sector is the engine room for the economy. Behaviours & Attitudes surveyed 358 SME business owners/managers across multiple sectors and counties to get their views on current business activity and their future forecasts.

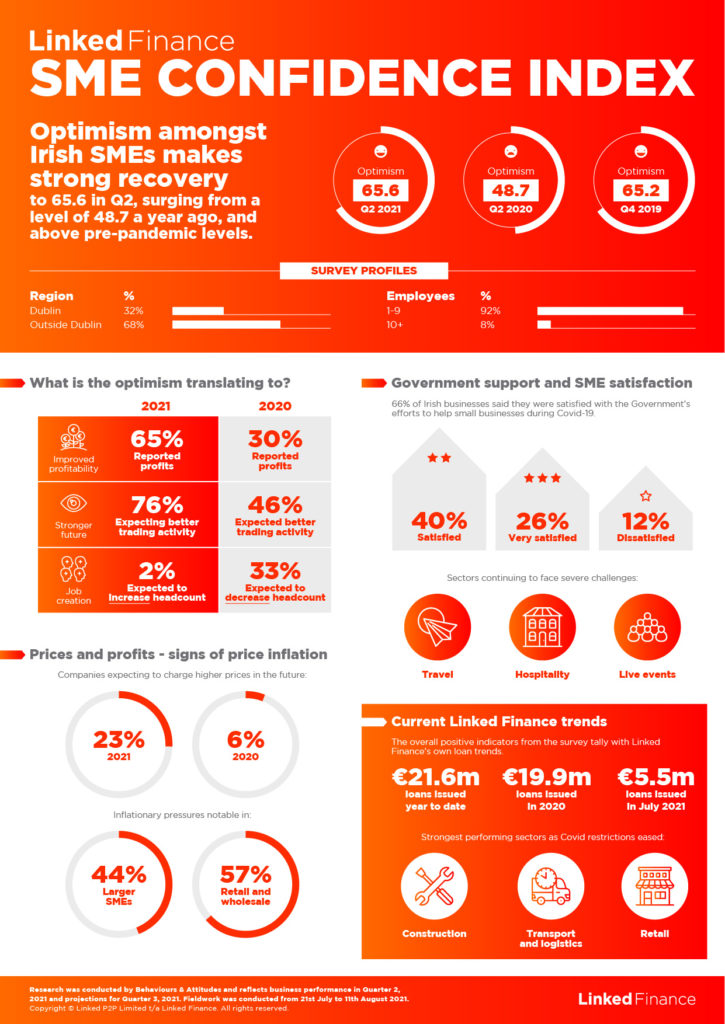

The index showed that optimism amongst Irish SMEs was at 65.6 in Q2 of this year. This score is an increase from 48.7 a year ago and above a pre-pandemic level of 65.2 in Q4 2019.

SME Confidence Index key takeaways

- The confidence level is at 65.6 in Q2 2021, up from 48.7 a year ago

- Profitability and job creation sentiments are improving, but there are signs of growing price inflation

- 66% of SMEs are satisfied with the Government’s Covid-19 response

- There has been weaker trading performance for micro-enterprises (1-3 employees)

“It is very encouraging that Irish SMEs are recovering from the huge challenges they have faced through the pandemic. Not only has business optimism rebounded to pre-pandemic levels, but the future outlook is for this trend to strengthen. We are, however, still seeing pockets of the economy that are slower to rebound, and it’s clear that the pace of recovery is lagging for domestic market focussed micro-businesses.”

Niall O’Grady, CEO, Linked Finance